Hey hey, stablecoinjoyers! As you may remember from previous reports, we categorize stablecoins into three groups and blockchains into four. The groups of stablecoins are named “leagues” and the chains are named “tiers.” Let’s begin this week’s stablecoin report. In this report, you will find:

-

Total review of the stablecoin market and a breakdown by projects.

-

Total breakdown of the stablecoin market by blockchains.

-

The most attractive stablecoin yields.

-

Important events and news from the last week.

-

Useful resources for more stablecoin information.

Total Review of Stablecoin Market and Breakdown by Projects

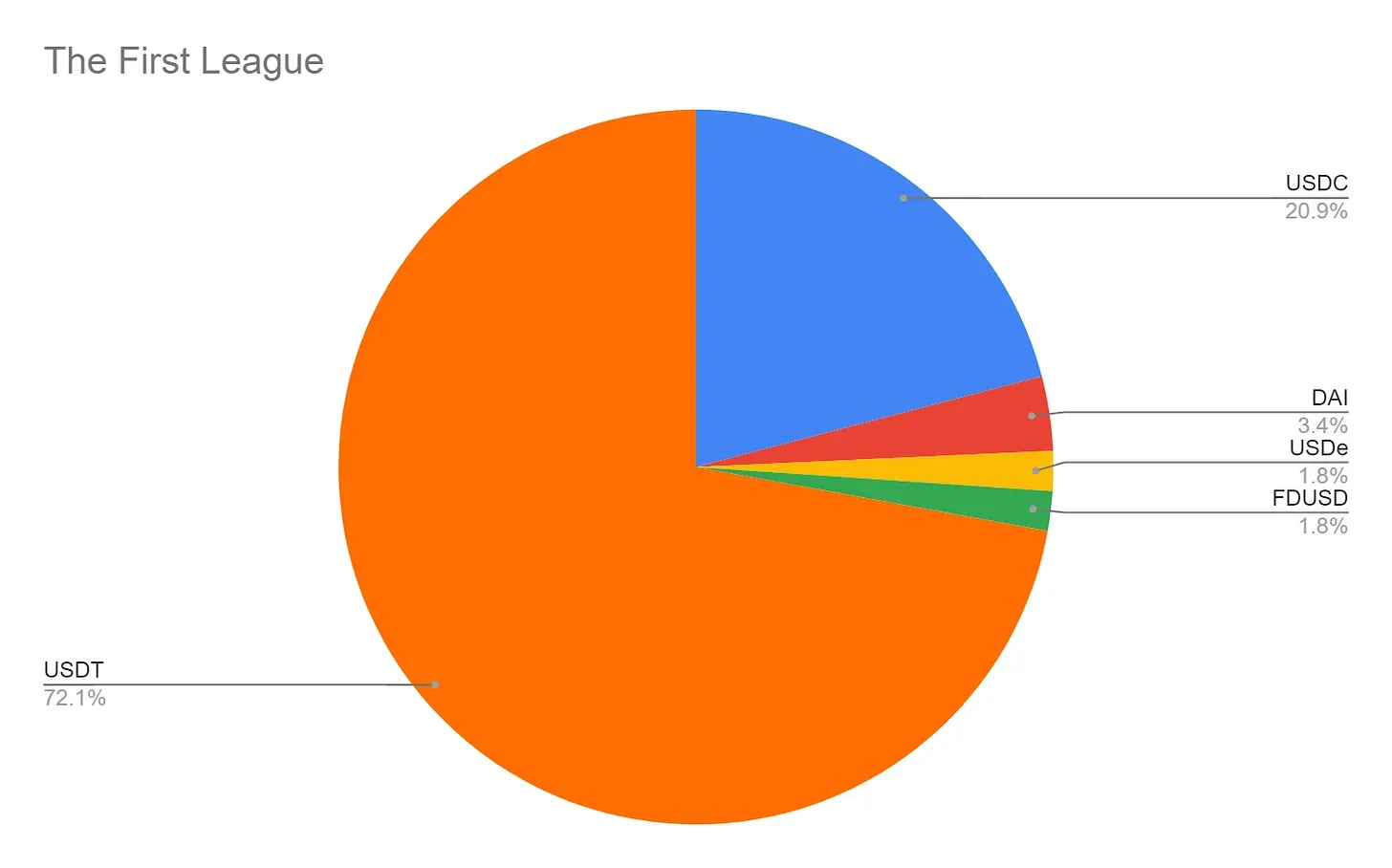

As of May 26th, the total stablecoin market is $161.08 billion, the same as last week. USDT’s dominance of the entire stablecoin market is 69.36%, compared to 68.99% last week. The pie chart below shows the dominance of Tether relative to other stablecoins with a market cap over $1 billion, i.e., the stables of the first league.

Last week, Tether’s dominance of the first league reached 72.1%, up from 71.6% the previous week. FDUSD’s market cap fell 13.05% last week; it’s important to note that it dropped by 7.59% the previous week as well. DAI faced a 4.34% drop last week, resulting in a $220M market cap decrease. Ethena’s USDe was the biggest gainer with a 13.41% market cap increase, following its 6.39% growth the previous week. The table below shows the 7-day change in market cap of the stablecoins in the first league.

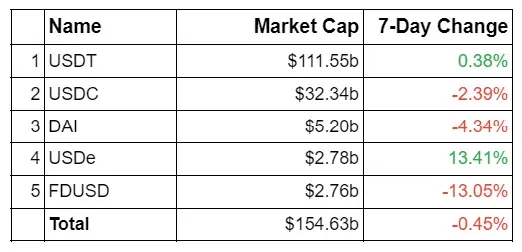

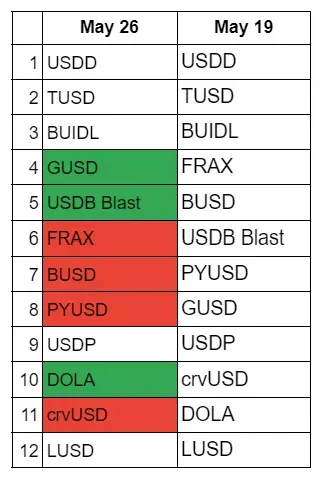

Now, let’s take a look at the second league, i.e., stablecoins between $100M and $1B. In the second league, there were major movements last week. The total market cap of this league grew by 18.77%, reaching $4.07B. We saw 7 of the stablecoins in this league change positions. Here is the comparison of their positions compared to the previous week. The green ones are position gainers, whereas the red ones are position losers.

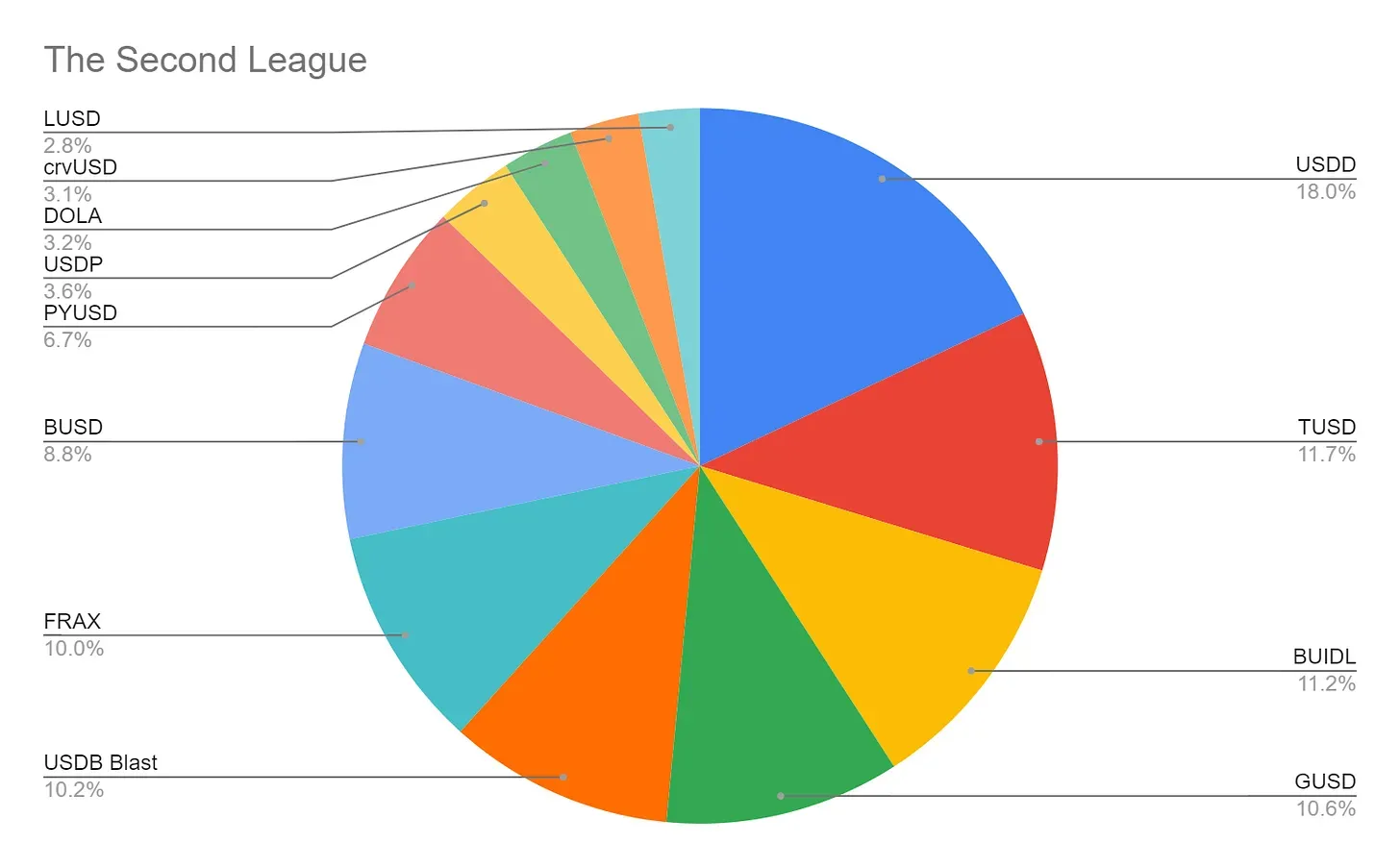

The pie chart below illustrates the market cap distribution of the stablecoins of this league.

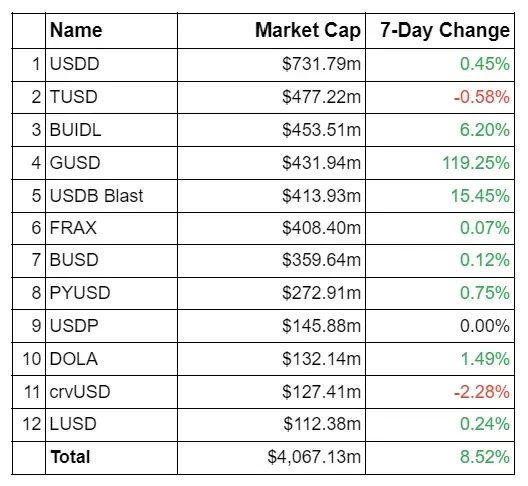

Gemini’s GUSD reached a $431.94M market cap with 119.25% growth. It’s worth mentioning that two weeks ago, the market cap of GUSD was around $80M. The second most significant growth belongs to USDB, with a 15.45% increase, reaching a market cap of $413.94M. Additionally, BlackRock minted around $26.5M in new BUIDL, corresponding to a 6.20% increase. Overall, the market was green last week, except for TUSD and crvUSD. The table below shows the 7-day change in market cap of the stablecoins in the second league.

Let’s explore the third league, i.e., stablecoins between $30M and $100M. In this section, there are 12 stablecoins; in the previous report, we had 13 stablecoins. The market cap of Ondo’s USDY reached above $100M; however, instead of distributing the yield with newly minted tokens, Ondo prefers increasing the face value of USDY. This makes USDY positively depegged. Since we only focus on stablecoins pegged to USD, we are not listing USDY anymore. Additionally, USP is not listed anymore since the project dissolved. Due to these listing preferences, 6 stablecoins in this league changed their positions. Here is the comparison with the previous week.

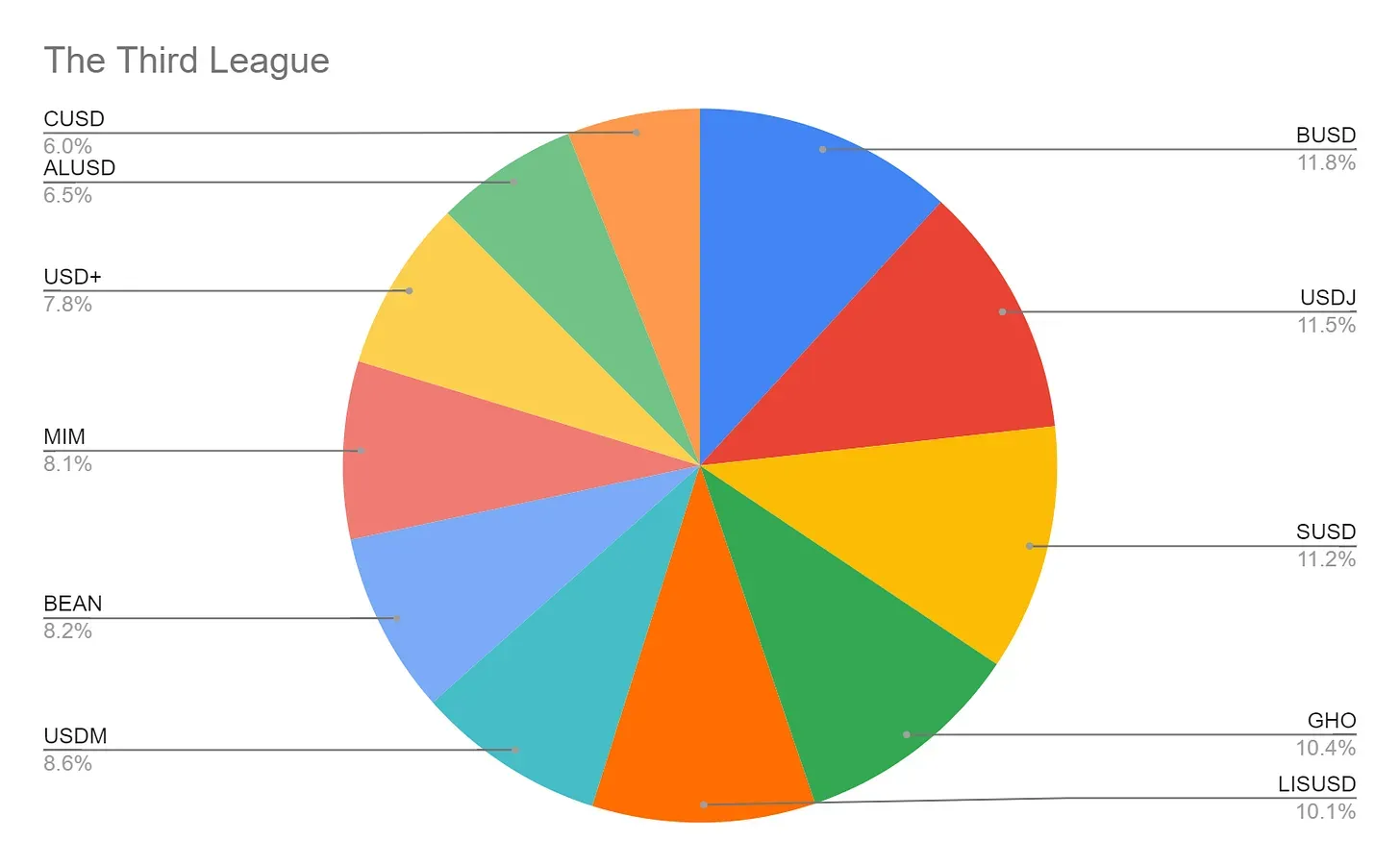

The pie chart below illustrates the market cap distribution of the stablecoins of the third league.

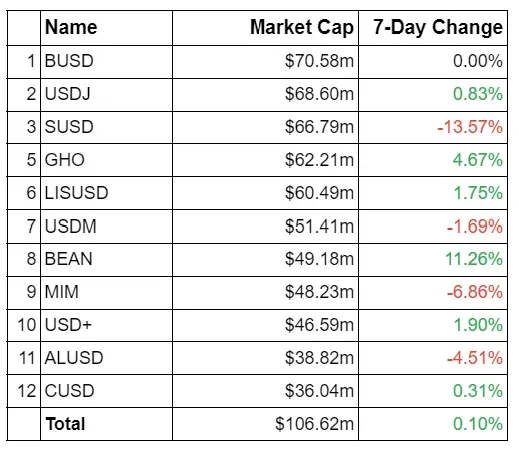

The biggest gainer in the third league was BEAN, with an 11.26% market cap increase, followed by GHO with a 4.67% market cap growth. On the loss side, the leader is SUSD with a 13.57% market cap decrease, followed by MIM with a 6.86% market cap decline. Additionally, ALUSD saw a 4.51% decrease in its market cap. The table below shows the 7-day change in market cap of the stablecoins in the third league.

Total Breakdown of Stablecoin Market by Blockchains

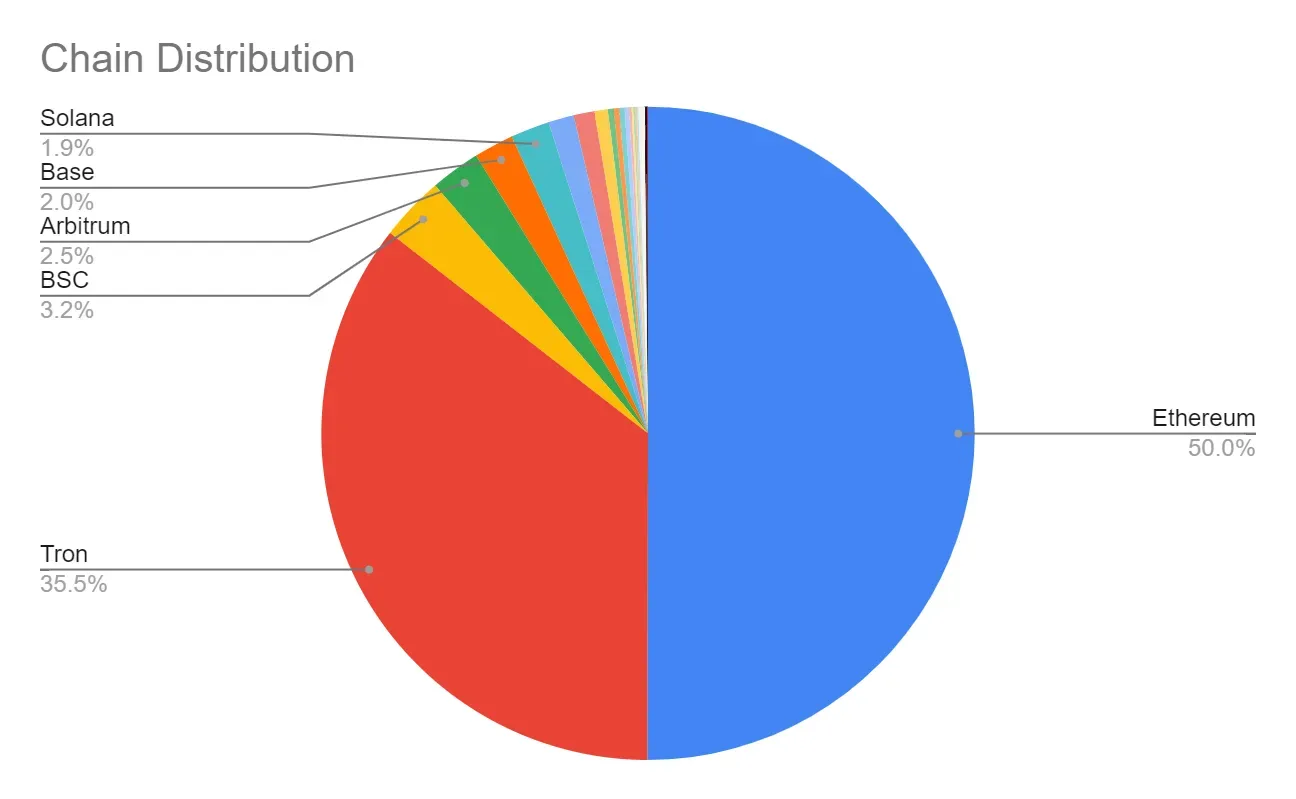

Now, let’s examine the competition among chains to attract more stablecoins. Just like last week, Ethereum and Tron hold more than 85% of the total stablecoin market.

Last week, the dominance of Ethereum decreased by 0.8%, making it 50%, whereas Tron’s increased by 0.1%, making it 35.5%. To analyze the competition, we need to exclude Ethereum and Tron, just like in previous reports.

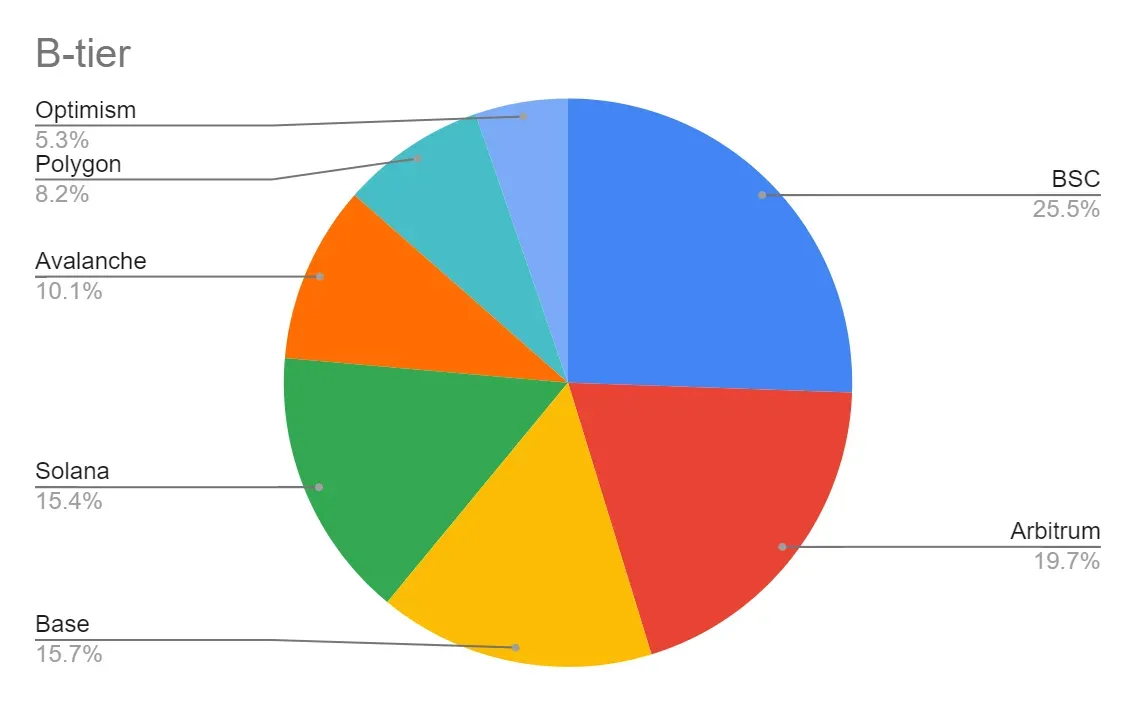

Now, let’s start with the B-tier chains. This tier has $20.11B stablecoins, with a 1.68% increase compared to the previous week. Last week, Base flipped Solana and became the third biggest chain in this league. Here is a pie chart of the B-tier chains.

Here, Base attracted more than $300M in new stablecoin issuance, corresponding to an 11.15% growth. Additionally, Avalanche gained a notable stablecoin market cap with a 5.75% increase in total stablecoin issuance. The biggest stablecoin loser of the week was Solana, with a 2.71% decrease. The other movements were quite limited. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the B-tier.

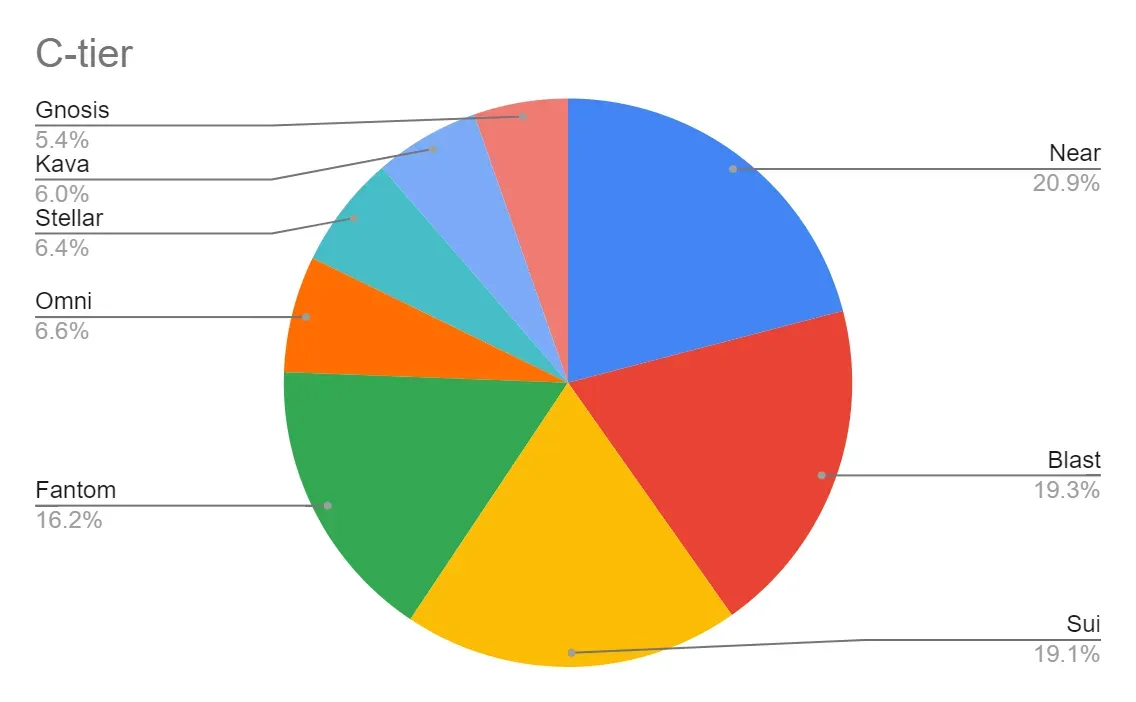

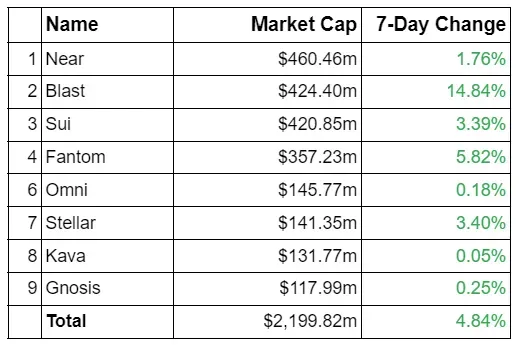

The C-tier comes with a 4.84% overall growth and a flippening. The previous week, Blast was holding the third position, but after a 14.84% growth (remember, USDB grew 15.45% as mentioned above), it replaced Sui and became the second biggest chain in terms of stablecoins in this tier. The pie chart below illustrates the market cap of the stablecoins on blockchains in the C-tier.

Following Blast, Fantom was the second highest growing chain in terms of stablecoins, with a 5.82% increase. All the chains in the C-tier were green last week. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the C-tier.

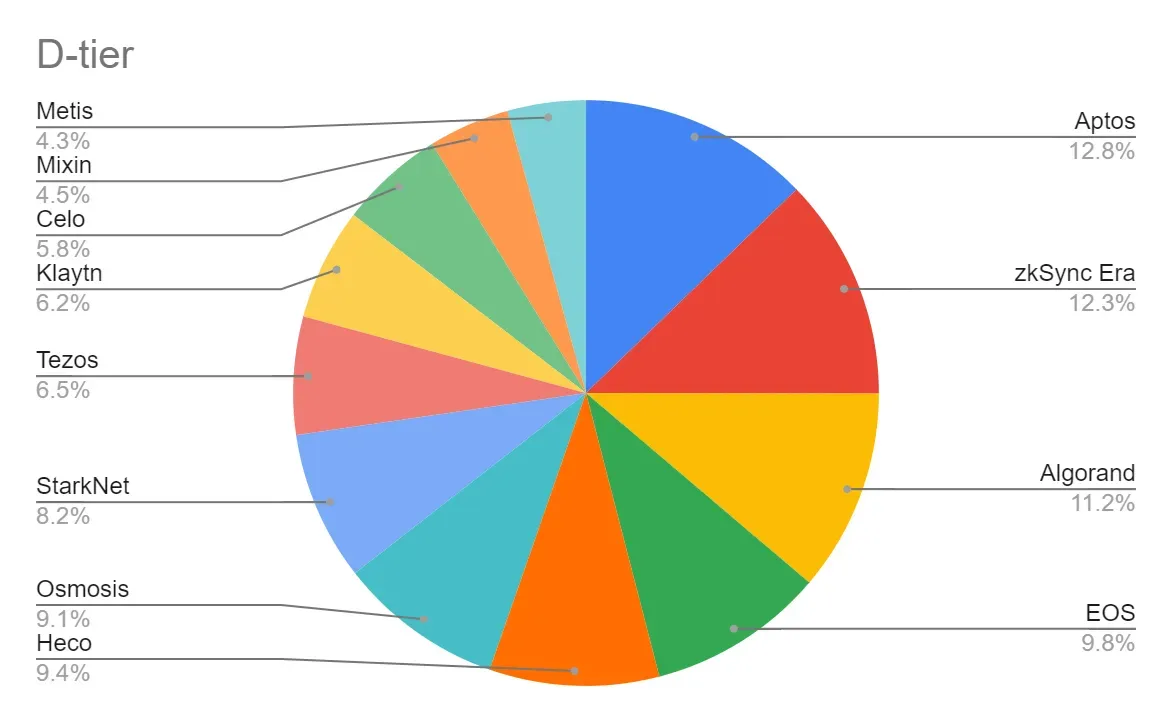

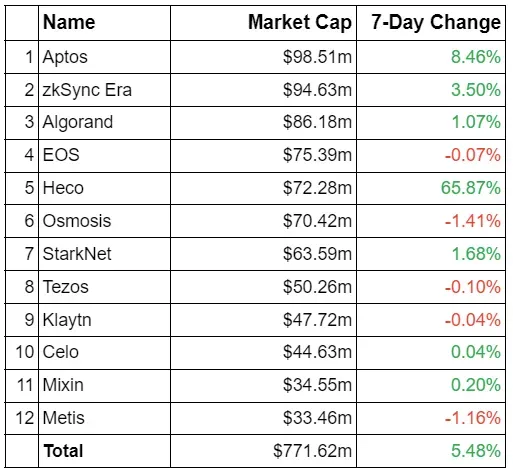

The D-tier contains 12 blockchains, having a total of $771M in stablecoins with a 5.48% increase compared to the previous week. Last week, Mode was also listed since it had more than $30M in stablecoins the previous week. However, it will not be listed again until it exceeds $30M. We saw two flippenings in the D-tier last week. The first one was Aptos-zkSync. The previous week, zkSync was the chain with the most stablecoins in this tier, but with Aptos’ 8.46% growth in terms of stablecoins, it is now the second chain of the tier. Additionally, we saw a huge leap by Heco. It was the tenth biggest chain in this tier the previous week, but last week it reached the fifth position.

Heco was the most significant stablecoin gainer this week by percentage. It gained around $30M in stablecoin issuance, corresponding to a 65.87% increase. This was followed by Aptos with an 8.46% increase, while the other chains’ gains and losses were relatively slight. The table below shows the 7-day change in market cap of the stablecoins on blockchains in the D-tier.

The Most Attractive Stablecoin Yields

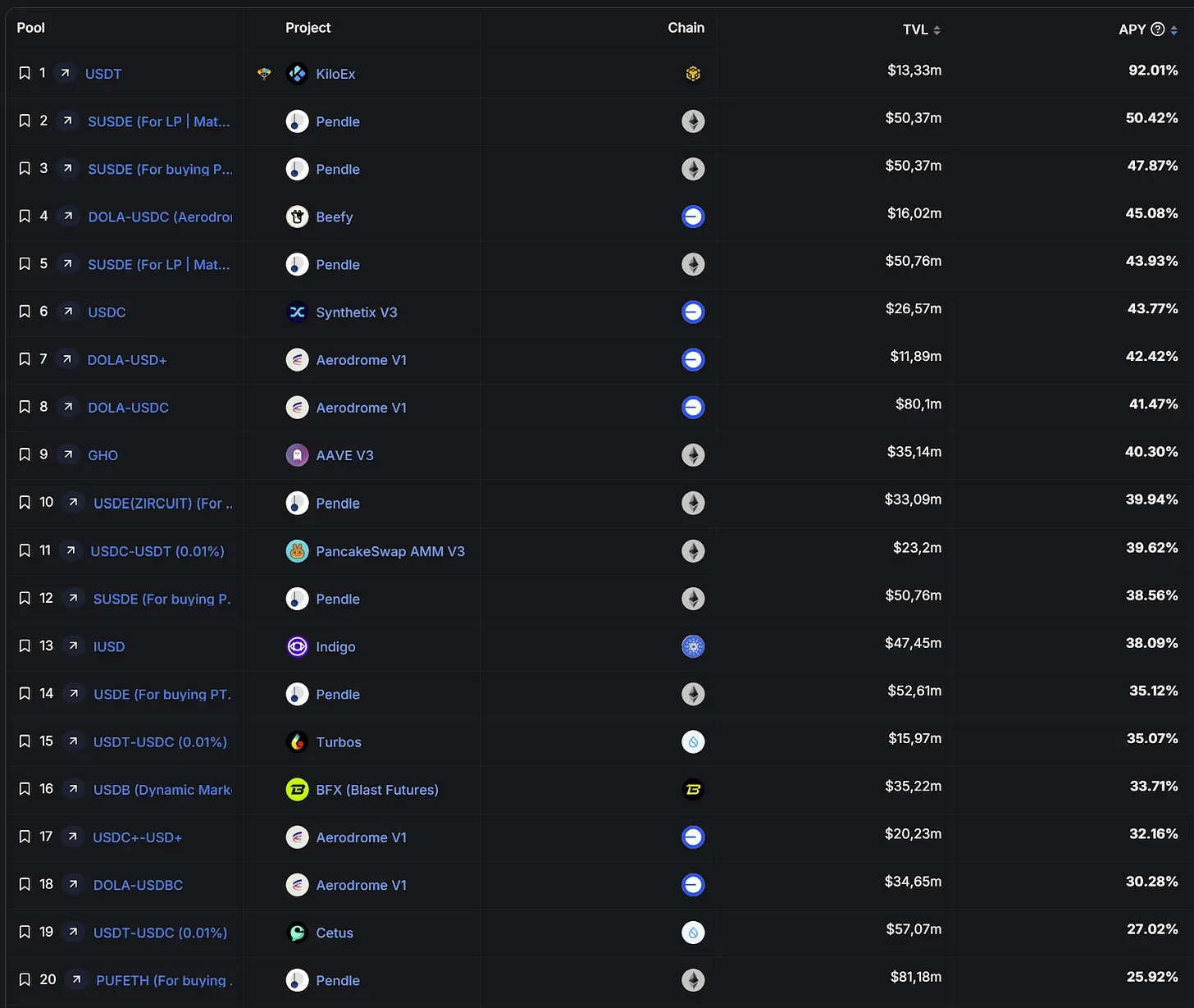

Let’s take a look at the stablecoins offering the highest APYs. These yields are sourced from DeFiLlama and include all types of yields with over $10 million in TVL. Remember that interactions with contracts carry various risks, including hacks, exploits, impermanent loss, depegging scenarios, etc. Please be aware of these risks before engaging and always DYOR!

-

Nomura and GMO Group Form Stablecoin Partnership in Japan Nomura Holdings and GMO Internet Group have partnered to explore the issuance of Japanese yen (JPY) and U.S. dollar (USD) stablecoins in Japan. The collaboration, which includes Laser Digital Holdings, will focus on regulatory compliance and stablecoin services. This initiative aims to enhance digital asset accessibility and innovation within Japan’s financial landscape.

-

Ripple CEO Criticized Over Tether Comments Ripple CEO Brad Garlinghouse faced criticism for comments suggesting the U.S. government is targeting Tether. Samson Mow, CEO of Jan3, accused Garlinghouse of spreading fear and uncertainty to compete against Tether. Garlinghouse clarified his comments, stating that Tether is an important part of the ecosystem, but concerns remain about increased regulatory scrutiny.

-

Kraken Maintains USDT Listing in Europe Amid MiCA Review Kraken announced it has “no plans” to delist Tether (USDT) in Europe, despite a Bloomberg report suggesting otherwise. The exchange is actively reviewing its compliance with the upcoming Markets in Crypto-Assets Regulation (MiCA) framework but intends to continue offering USDT to European customers while adhering to all legal requirements.

-

UK Election Date Set, Crypto Hub Plans Uncertain UK Prime Minister Rishi Sunak announced a general election for July 4, potentially ending the Conservative Party’s crypto-friendly governance. The opposition Labour Party, which is leading in polls, has been silent on crypto regulation but has expressed interest in promoting tokenization. The outcome of the election could impact the future of the UK as a crypto hub.

Useful Resources for More Stablecoin Information

Last Words

I hope you’ve found this report informative. See you in the next report. In the meantime, you can read other posts on Ethereum2077. And if you missed last week’s report, you can read it here. Finally, keep enjoying stability!